Automate the Detection of Fraud and Anomalies in

Documents with Fraud Check AI

Secure

Ensuring SOC 2 Type 2 compliance, automated redaction, and data-purge rules to protect information, reducing breaches.

Fast

Every business is unique, and our document solution adapts to your needs whether for a small team or a large enterprise.

Plug n Play

Easy to integrate into existing workflows or legacy systems via iFrame or API.

Verify the Authenticity of Documents

and Detect Fraud Instantly

Enhanced Accuracy & Detection

Multi Layered Fraud Score Analysis & Detection

Fraud Check AI performs intelligent fraud checks by analysing document structure, metadata and digital fingerprints to identify manipulation or forgery. It delivers accurate results and strengthens decision making with advanced AI risk scoring.

Increased Speed & Efficiency

Fast Data &

Document Verification

Automatically verify documents in real time using AI powered checks that detect inconsistencies and errors. This reduces manual reviews, improves operational speed and ensures faster, more reliable approvals for financial institutions.

Boost Compliance & Assurance

Cross Check with Trusted Data Sources

Validate document authenticity by connecting with verified external databases such as government, internal, ABN, BSP, company registries and across multiple dataset. This ensures compliance, enhances data integrity and protects against falsified or manipulated financial records.

Improved Flexibility & Control

Custom Fraud Rules

Configure tailored fraud rules to fit your organisation’s policies and risk thresholds. Apply dynamic and static checks across specific document types to detect complex fraud patterns and maintain regulatory confidence.

Key Features

Your all-in-one fraud check powerhouse, with over 20+ features for a faster, easier workflow.

Detect AI Generated Docs

Instantly identify whether a document or image was created using AI.

Calculations Verification

Automatically validates calculation items within a document based on its category, such as verifying totals or known summations.

Multi Dataset

AI-driven deepfake detection to identify any manipulations.

Bulk Processing

Supports processing of up to 200 documents, with a maximum total of 2,000 pages.

Feedback Loop

Provide feedback to the model to improve accuracy for specific files and future documents.

Report Generation

Generates a full report of all fraud check categories performed, including the final score and decision for the document.

Signature Verification

Verifies handwritten or electronic signatures against reference datasets or detect modifications and copies with in the document.

Inconsistency Detection

Detects discrepancies and inconsistencies within the document by analysing both its context and content.

Metadata Analysis

Performs comprehensive document metadata analysis to identify origin, authorship, potential fraud activities, and modification history.

Category Fraud Assessment

Performs document category–based fraud checks, applying specific verification rules tailored to each document type.

Context Checks and Validation

Validates the contextual flow within a document to ensure logical consistency and coherence.

Cross Checking Capabilities

Cross-checks the validity of information within a document against multiple datasets to detect potential fraud attempts.

Raw File Binary Analysis

Performs raw structure analysis of the document file to ensure there are no unauthorised structural changes or modifications.

Document Structure Analysis

Analyses the document’s internal structure to ensure no unauthorised structural changes to its content.

Hidden and Overlay detection

Automatically detects overlaid or hidden edits within the document.

Out of the Box Document Categories

Financial Statements

Payslip

Notice of Assessment

Income Statements

BAS Statements

Credit Card Statements

Banks Statements

Invoices

Driving Licence

Passports

Credit Cards

Insurance Documents

Tax Returns

Car Invoices

Utility Bills

Land Certificates

Federal Issued Documents

+170 more

Secure and Scalable

Enterprise-grade Security

We adhere to stringent information security policies to safeguard your sensitive customer data. Our measures include best-in-class encryption (at rest and in transit), comprehensive audit logs, robust access management, approval-based data access, multi-factor authentication across our business, IP filtering, and more. We are SOC2 Type 2 certified and PCI DSS compliant, with annual external audits and regular cybersecurity penetration tests.

Scalable Infrastructure

Our robust and scalable infrastructure empowers your business to grow without compromising performance or stability. Our cloud-based technology features highly automated scalability, both horizontally and vertically, within a service-oriented architecture. Additionally, we comply with local data sovereignty requirements, ensuring data is stored locally to meet regulatory standards and protect your information.

Reliable Uptime

Experience industry-leading uptime and availability, allowing you to focus on serving your customers without interruption. We offer 99.97% uptime, live data replication across multiple geolocations, and the option to select preferred data locations based on jurisdiction.

Recognised Innovator

Proud finalist for the Australian AI Awards 2025 in the categories - AI Innovator in Mortgage Broking, AI Innovator for Start Up, Best use of AI for Sustainability, AI Innovator in Consumer Banking, Best Use of Agentic AI and finalists for the Smart50 2025 in the categories - Innovator Award, Sustainability Award and Founder of the Year Award.

Business Benefits

120

x

Faster than manual fraud analysis, completing verifications in seconds instead of hours.

50

x

More cost-effective than manual fraud checking, saving on labor and operational expenses.

87

x

Fewer errors than human fraud analysis drastically reducing costly mistakes.

*Note that the benefits listed above are based on current client outcomes and may vary depending on your specific use case.

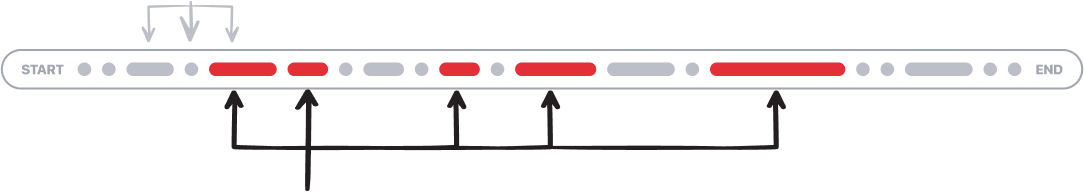

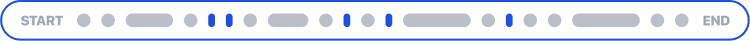

How We Boost Your Workflow

These lines represent the stages of your workflow based on time.

Understand your business workflow

Identify manual processes that can be improved

Tailor a new workflow with AI and Automation services

Integrate the services in your legacy system

Delivery and training your team

The blue stages represent the optimisation impact from our services.

Let’s Connect

We’re here to help! Have questions or need more information? Get in touch with us today.