AI Fraud Prevention in Australia: How Businesses Can Stay Ahead in 2026

Last Update: 14 January 2026

Fraud is no longer a compliance box to tick. It has become a national crisis threatening trust, reputation, and business continuity. In 2025 alone, Australians lost more than $2.03 billion to scams and document-based fraud (Security Brief, 2025). Over 70,000 government-issued IDs were reported stolen or misused (Cyber Daily, 2025), and digital document forgeries surged by 244 per cent year-on-year (IDM, 2025).

This is not petty crime. It is a sophisticated, AI-powered operation that is redefining how banks, brokers, and businesses in Australia handle trust and verification.

The Fraud Tsunami Hitting Australia

From mortgage misrepresentations to billion-record data breaches, fraud is hiding in plain sight.

- The Salesforce data breach exposed nearly one billion customer records, affecting brands such as Qantas, Adidas, and Marriott. The stolen information became the foundation for identity theft and synthetic identities.

- UBS research revealed that one in three Australian home loans contained false or inflated information, representing $500 billion in misrepresented lending.

- A National Australia Bank (NAB) manager was charged in connection with a $200 million ghost-loan scheme, using forged documents and stolen credentials.

- In Sydney, a so-called fortune teller defrauded the Vietnamese community of $70 million using falsified loan paperwork and manipulated financial statements.

These incidents show that Australia’s fraud epidemic is not a matter of “if” but “when”. Every business, regardless of size, is now operating in an environment where AI-enabled fraudsters are moving faster than legacy systems can detect.

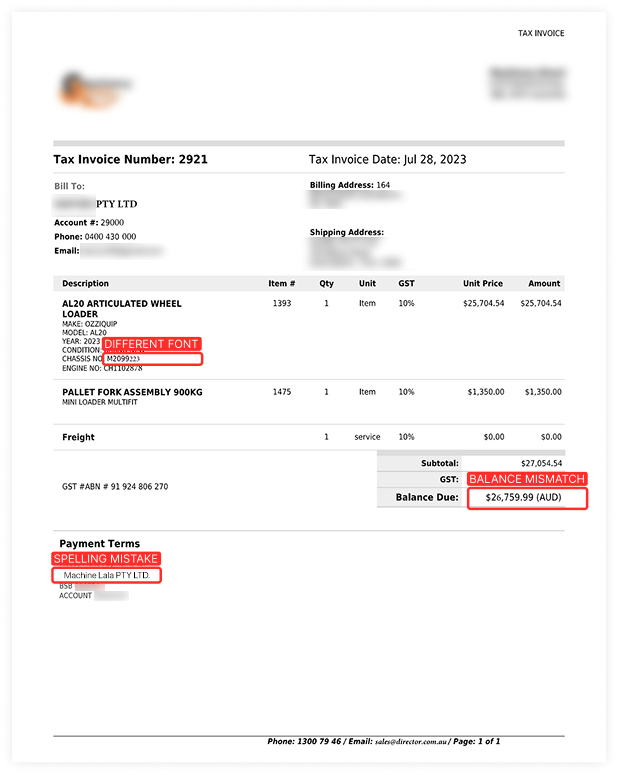

Examples of Fraud Hiding in Plain Sight

How AI Made Fraud Invisible

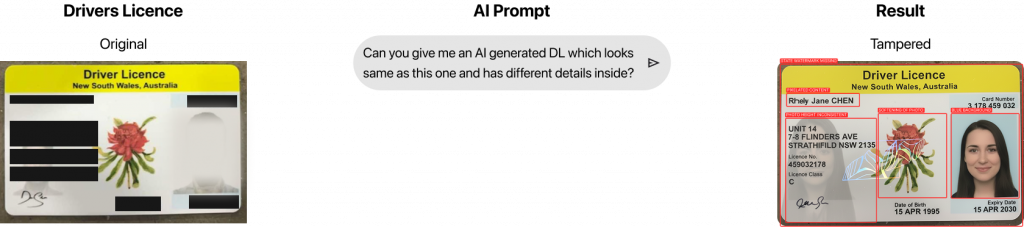

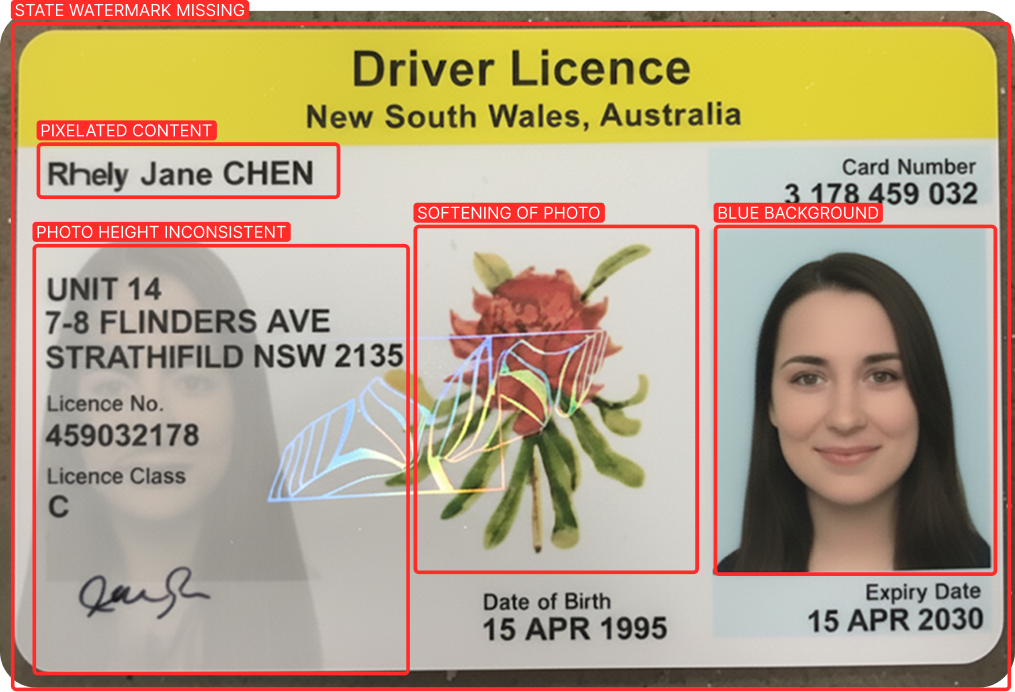

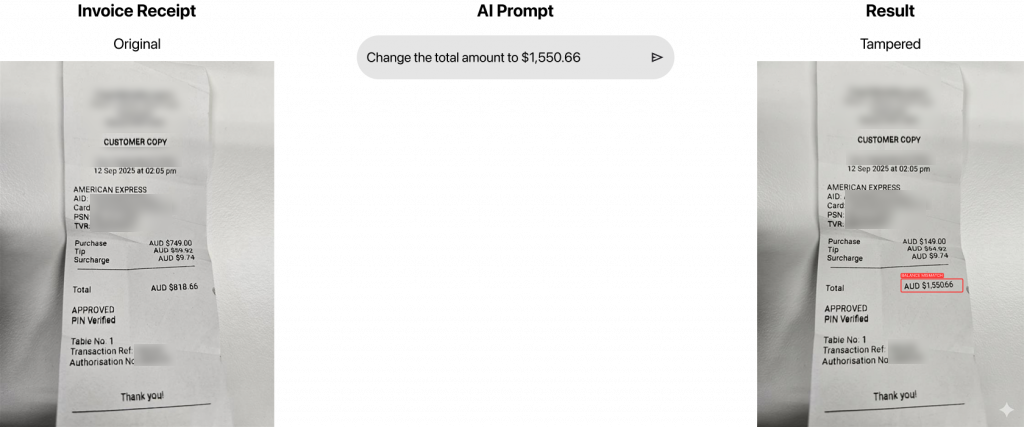

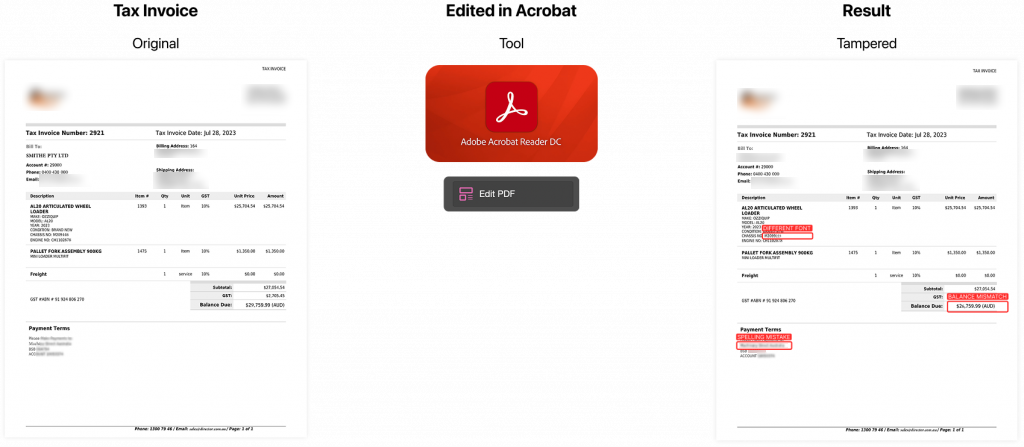

Human reviewers once had a fighting chance. Today, one line of text in a generative AI tool can create a near-perfect NSW driver’s licence, a forged tax invoice, or a tampered payslip that passes most compliance checks.

AI has democratised deception. Traditional manual verification methods, outdated OCR systems, and static KYC or AML controls cannot detect these advanced forgeries in time.

Fraud’s New Weapons: Data Breaches, Deepfakes, and Synthetic Identities

According to Security Brief Australia, AI-driven identity fraud is rising sharply through deepfake and data injection attacks. Criminals can now take the advantage from the use breached data from incidents such as Salesforce’s to create hyper-realistic digital personas. These can pass through onboarding and lending processes undetected.

This growing sophistication extends beyond the financial sector. Government, education, and healthcare institutions are also under siege because their document verification processes were never designed for the scale or precision that AI-generated fraud now demands.

Research shared by Commonwealth Bank shows that about one in four Australians (27 %) reported witnessing a deepfake scam in the past year. Among those incidents, investment scams (59 %), business email compromise scams (40 %), and relationship scams (38 %) were the most common. The study also found that 41 % of small business owners were familiar with deepfake scams, and 50 % of deepfake scam attempts on small businesses arrived via email, while only 55 % had cross-checked supplier payment details in the prior six months.

The Cost of Inaction: Trust, Reputation, and Revenue

Australian CIOs and CTOs now list document authenticity, AI misuse, and data security among their top five cybersecurity priorities, surpassing ransomware concerns. When a forged document enters your workflow, the financial loss may be immediate, but the reputational damage lingers for years.

Trust, once lost, cannot be insured or rebuilt overnight.

The Turning Point: AI Versus AI

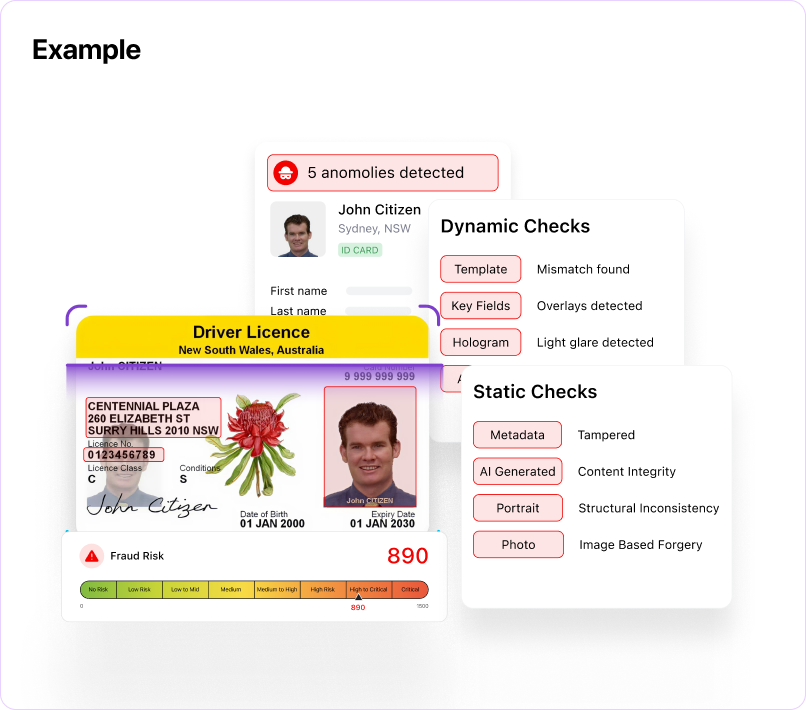

This is where DoxAI’s Fraud Check AI transforms the landscape. Fraud Check AI is an AI-powered tool that detects file manipulation and fraudulent document creation. It analyses file structures with advanced algorithms to spot potential fraud. It also checks and compares data to find errors, discrepancies, and inconsistencies, whether within a single document or across multiple datasets.

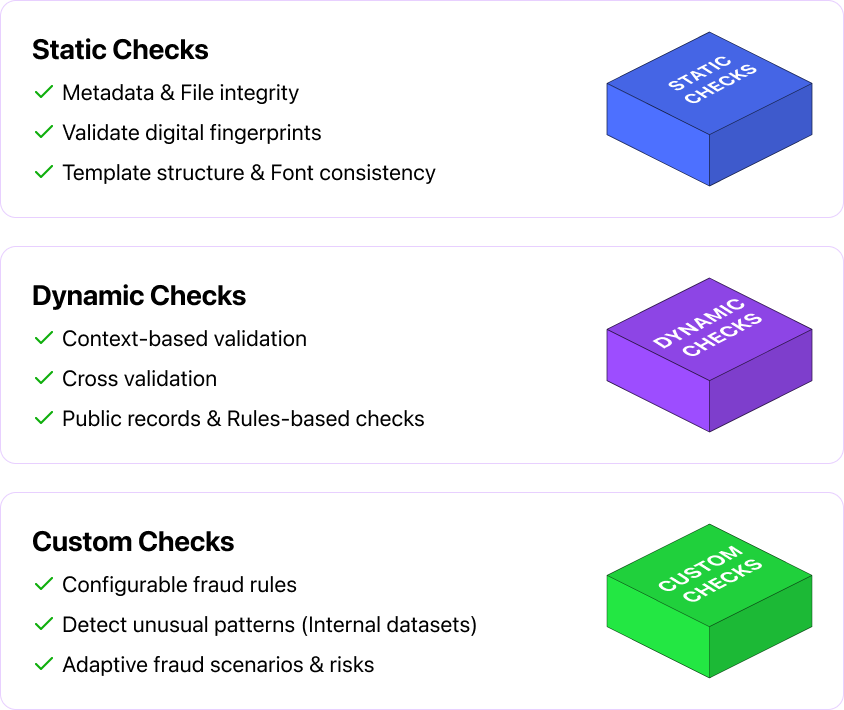

These checks can also include verifying a document’s contents against external data sources to confirm authenticity.Built from years of research and adversarial testing, its three-layer methodology combines precision with speed:

- Static Checks – Examine the file’s structure, metadata, and embedded code to uncover hidden tampering.

- Dynamic Checks – Validate the logic, calculations, and identity consistency within the document.

- Custom Checks – Adapt verification to your organisation’s compliance rules, jurisdictions, and fraud-risk thresholds.

Each document is inspected with the accuracy of a digital forensic investigator, processed in seconds, and returned with a full fraud risk report.

Want to see how it works? Book a free demo with our expert.

Experience Return on Investment (ROI) and Performance

DoxAI processes over 540 million documents each year, training its Fraud Check AI to detect anomalies across formats, languages, and data structures. The outcomes speak for themselves:

- 120x times faster than manual verification

- 50x times more cost-efficient than human review

- 87x times fewer errors in fraud detection

Documents once reviewed in hours are now cleared or flagged in seconds, protecting organisations before the damage is done.

The Fraud Check AI Defence That Works

Fraud Check AI is built for Australia’s enterprise and regulatory landscape. It identifies synthetic identities, catches manipulated invoices, and prevents multi-million-dollar losses before approval.

It is backed by SOC 2 Type 2, ISO 27001, GDPR, HIPAA, and PCI DSS compliance, and operates with 99.97 per cent uptime and real-time data replication across Australian data centres.

In a world where cyber threats evolve daily, reliability and compliance are a must.

Fraud Check AI Out of Box Categories

- Financial Statements

- Payslip

- Notice of Assessment

- Income Statements

- BAS Statements

- Credit Cards & Statements

- Bank Statements

- Invoices & Utility Bills

- Driving License

- Passports

- Insurance Documents

- Tax Returns

- Land Certificates

- Federal Issued Documents

- And 170+ more

The Future of Fraud Prevention Is Adaptive AI

Fraudsters evolve, and so does DoxAI. Through continuous adversarial testing and AI risk management, Fraud Check AI learns from every anomaly and every false positive. This ensures the system adapts faster than fraud tactics can change.

This is where cybersecurity, finance, compliance, and AI ethics converge the responsible use of artificial intelligence to fight the misuse of artificial intelligence.

Integrate DoxAI’s Fraud Check AI with

The Bottom Line

Australia’s fraud problem is escalating, but your organisation’s defences do not have to lag. Fraud Check AI gives leaders the confidence to protect data, verify authenticity, and maintain compliance at scale without sacrificing speed or accuracy.

The question is not whether fraud will occur, but whether your systems will detect it before it costs millions.

See the Future of Fraud Prevention

Book a live demo of Fraud Check AI and see how AI can help your organisation detect and prevent fraud before it happens.

About DoxAI

DoxAI is your trusted process automation partner, enabling to transition from outdated systems to cutting-edge AI technology. Our platform streamlines the collection, management, processing, and storage of data, enhancing security, reducing operational costs, and boosting customer engagement. DoxAI empowers providers to automate and secure every step of their data and document handling processes. Our suite of products supports end-to-end workflows, from intake to archiving, ensuring privacy, compliance and faster service delivery.

Author

-

Sayem Shakir is a marketing and growth leader for AI, automation, and regulated technology platforms. He specialises in translating complex AI, data governance, and compliance driven products into clear, commercially relevant content for C suite and enterprise audiences. He has over 12 years of experience across marketing, sales, and strategy, with hands on leadership roles spanning fintech, legal tech, govtech, and enterprise AI. Sayem has led go to market strategy, demand generation, content, events, and partnerships, helping technology companies scale adoption in highly regulated industries. His work focuses on AI solutions, digital transformation, AI risk & governance, secure document intelligence, secure verification solutions, and automation in finance, healthcare, legal, education, and government. He regularly writes and advises on responsible AI adoption, risk, and compliance.

Frequently Asked Questions

What is document fraud and why is it rising in Australia?

Document fraud involves altering, forging, or fabricating documents such as IDs, bank statements, or invoices to deceive businesses or authorities. In Australia, document fraud is rising due to the use of AI-generated forgeries, deepfakes, and synthetic identities that can bypass traditional verification systems. According to Security Brief Australia (2025), deepfake and injection attacks have surged by over 40% year-on-year, making AI-driven document verification tools essential for fraud prevention.

What are the most common types of fraud affecting Australian businesses in 2026?

The major fraud categories impacting enterprises include:

- Document manipulation and forgery in financial, legal, and lending documents.

- Identity fraud and synthetic identity scams using stolen or fabricated personal data.

- Payment and invoice fraud, where fake vendors or altered account details divert funds.

- Application and mortgage fraud, including falsified income and asset declarations.

- Internal and third-party data fraud caused by weak access control and compliance gaps.

These threats have made fraud prevention and AI risk management a top priority for CIOs and compliance officers in 2026.

How does Fraud Check AI help in detecting document and identity fraud?

AI-powered fraud detection solutions like DoxAI’s Fraud Check AI analyse document structure, metadata, and content provenance to identify manipulation or forgery. They perform static, dynamic, and custom checks across files to detect anomalies that humans often miss.

Fraud Check AI also compares data across multiple datasets, verifies identities in real time, and flags inconsistencies before approval, reducing financial losses, compliance risks, and operational delays.

How big is the fraud problem in Australia?

Recent reports estimate that Australia lost more than $2 billion to AI-driven scams in 2024, with over 70,000 government-issued IDs compromised in the past 12 months. Fraud linked to data breaches, forged documents, and synthetic IDs is growing by more than 20% annually, according to Indue’s 2025 Payment Fraud Report. These figures highlight how fraud has evolved from a compliance issue into a major business risk affecting every sector, from banking and finance to healthcare and education.

What compliance standards should fraud detection software meet?

Modern fraud detection software in Australia should comply with global and local regulations, including:

- ISO 27001 for information security management

- SOC 2 Type 2 for data privacy and operational integrity

- GDPR and Australian Privacy Principles (APPs) for personal data protection

- PCI DSS and HIPAA for financial and healthcare data security

Solutions like Fraud Check AI also maintain local data sovereignty, ensuring sensitive information is securely stored within Australian data centres.

How can financial institutions reduce fraud risk in loan and payment processes?

Financial institutions can strengthen their defences by:

- Implementing AI-driven fraud detection software for real-time document verification.

- Enforcing multi-factor authentication and metadata analysis for document validation.

- Regularly auditing workflow and access controls to detect insider threats.

- Integrating automated compliance systems that flag high-risk activities.

- Running continuous AI model training and risk scoring based on emerging threats.

Together, these measures significantly reduce fraud exposure, false approvals, and compliance penalties.

What makes DoxAI’s Fraud Check AI different from other fraud detection systems?

Fraud Check AI stands out for its multi-layered detection approach using static checks (to assess digital file integrity), dynamic checks (to validate data logic and accuracy), and custom checks (aligned to each organisation’s policy). It is document-agnostic, supporting over 180 file types including PDFs, scanned images, and audio/video formats.

The platform delivers real-time risk scoring, audit-ready reports, and 99.97% uptime across compliant, scalable cloud infrastructure. This makes it ideal for enterprises seeking AI-powered compliance, fraud prevention, and operational efficiency.

What industries benefit most from AI-powered fraud detection in Australia?

Industries facing high document and data verification volumes gain the most value, including:

- Banking and Financial Services (loan and KYC verification)

- Insurance (fraudulent claim detection)

- Government and Councils (document certification and procurement security)

- Legal and Compliance Firms (identity verification and contract integrity)

- Healthcare and Education (credential verification and data protection)

Across all, AI-driven fraud detection software enables real-time verification, risk scoring, and fraud prevention at scale.

How can organisations start using Fraud Check AI?

You can book a demo or request a proof of concept (POC) to see how Fraud Check AI detects anomalies and validates documents in seconds. DoxAI offers flexible subscription models and API integrations to fit existing workflows, with options for real-time verification, batch processing, or custom risk rules. Contact: sales@doxai.co or book a demo with our expert

Why is fraud prevention a business-critical priority for 2026 and beyond?

Because fraud now directly impacts trust, reputation, and compliance readiness. With generative AI accelerating document forgery and identity scams, organisations that rely solely on manual checks are increasingly vulnerable.

AI-led solutions like Fraud Check AI are not just fraud prevention tools — they are core compliance enablers that ensure every document, transaction, and identity is verified with confidence.