PPSR Checks for Faster and Safer Asset Finance Decisions

Last Update: 21 January 2026

PPSR and REVS Checks in Australia – A Lender Focused Guide to Safer Faster Asset Verification

In asset finance, every lending decision carries material risk. A single encumbered stolen or written off vehicle can expose lenders to financial loss recovery challenges and regulatory scrutiny.

This is why ppsr checks, ppsr car check, and REVS checks remain foundational to asset verification in Australia.

However relying on a ppsr or REVS check alone is no longer sufficient. Fraudulent documents altered vin, manipulated vin number, and inconsistent data across loan applications increasingly undermine traditional verification workflows.

This is where DoxAI’s Asset Verification enhances the PPSR process.

By combining official ppsr search data from the Australian Government Personal Property Securities Register at ppsr.gov.au with AI driven document intelligence DoxAI enables lenders to verify assets faster detect fraud earlier and approve loans with greater confidence.

What Is PPSR?

Understanding PPSR Meaning for Lenders

“What is ppsr” is one of the most common asset finance questions in Australia.

The ppsr meaning refers to the Personal Property Securities Register which is Australia’s national online register that records ppsr registration of security interests over personal property.

This includes vehicles machinery equipment inventory and other financeable assets.

A ppsr check or check ppsr search allows lenders and buyers to understand whether an asset is legally safe to finance or purchase.

What Is a PPSR Check in Australia?

“What is a ppsr check” is a critical compliance question for lenders.

A ppsr check refers to a search of the national PPSR system administered by the Australian Government.

A ppsr check reveals whether:

- An asset has finance owing or existing encumbrances

- An asset is recorded as stolen

- An asset has been written off due to damage or theft

For lenders a ppsr search forms part of the legal and compliance framework accepted by regulators including asic.gov.au and afca.org.au.

What Is a PPSR Report?

“What is a ppsr report” is commonly asked by lenders and brokers.

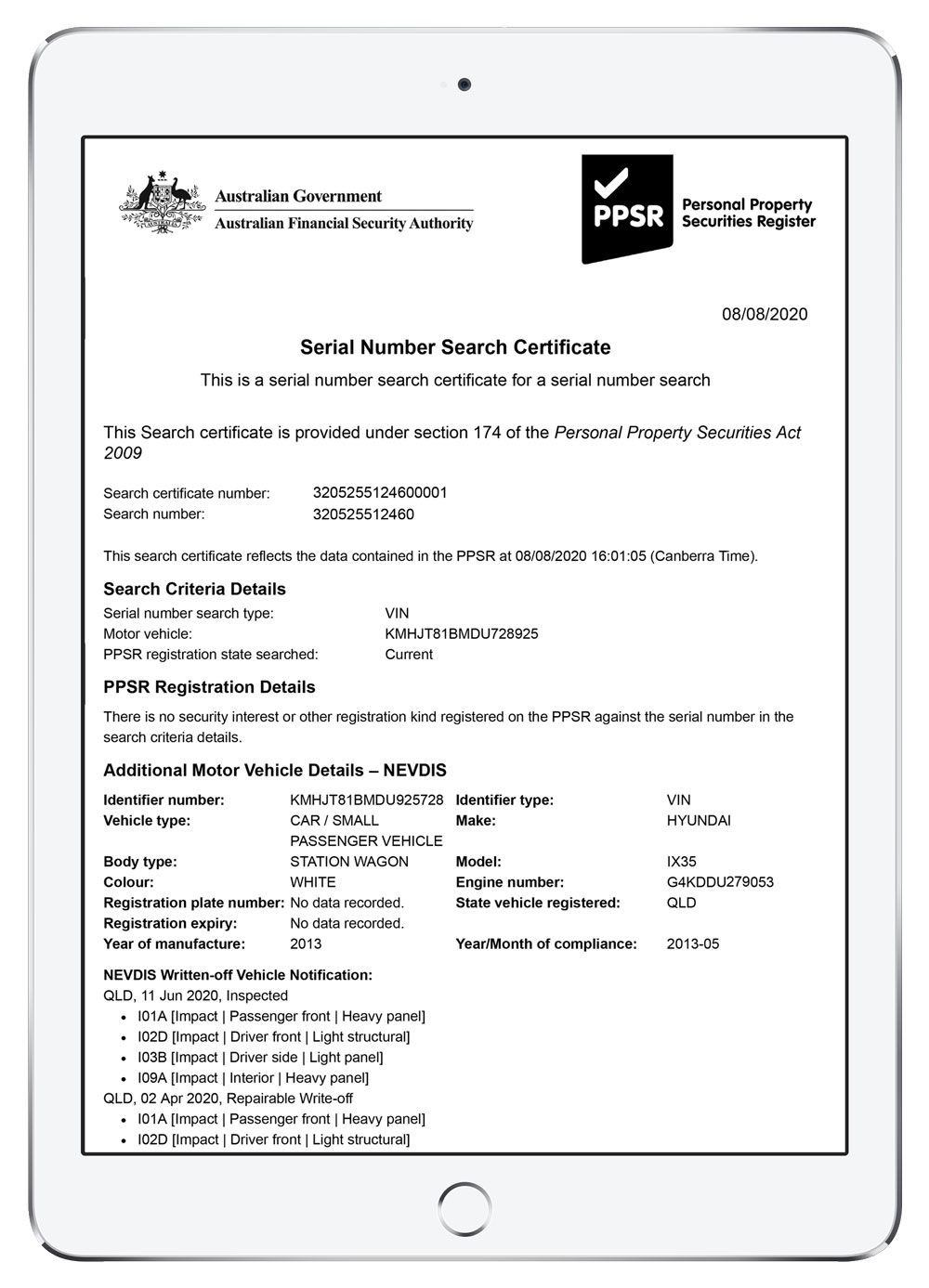

A ppsr report is the official output of a PPSR search and includes legally recognised information used in credit assessment and audit trails.

A ppsr report typically includes:

- vin or vin number details

- Security interests and ppsr registration records

- Stolen and write off indicators

- An official ppsr certificate issued via ppsr.gov.au

What Is a REVS Check?

PPSR Vehicle Check Explained

Before the PPSR system was introduced in 2012 Australian states relied on REVS.

Today a REVS check refers to a ppsr vehicle check or ppsr car check performed nationally.

Vehicle data used in PPSR searches is supported by government controlled datasets such as NEVDIS and state transport authorities.

A REVS style ppsr vehicle check typically provides:

- Finance owing

- Stolen vehicle status

- Write off history

- Core vehicle details including vehicle vin, engine number and body type

Why PPSR and REVS Checks Matter for Lenders?

Confirm Encumbrances Before Financing:

A ppsr search ensures an asset is free from existing claims before funding.

Avoid Financing Stolen or Written Off Vehicles:

A ppsr check discloses stolen and write off history sourced from regulated national registers.

Validate Vehicle Identity:

A ppsr vin check allows lenders to confirm they are financing the correct asset and not a substituted or cloned vehicle.

VIN Checks and Vehicle History Checks

Why PPSR Alone Is Not Enough?

Traditional vin check, vin lookup, or vin search workflows confirm database records only.

As a result, they do not verify whether documents are genuine.

Common lender risks include:

- Altered vin number images

- Fake vin checker outputs

- Reused or cloned vehicle vin

- Inconsistent vin number verification across documents

A vehicle history check without document intelligence leaves gaps in fraud detection and prevention.

How to Verify a VIN in Asset Finance?

Lenders frequently ask how to verify a vin correctly.

To verify a vin, lenders must:

- Check vin consistency across all documents

- Verify vin number against PPSR records

- Perform verify vehicle vin checks using images and documents

- Validate vin check australia data sources

DoxAI’s Asset Verification automates this process using AI.

Where PPSR and REVS Checks Stop, DoxAI Goes Further

While ppsr and REVS checks confirm legal standing they do not:

- Detect tampered documents

- Confirm vin number verification across files

- Identify repeated fraud patterns

DoxAI’s Asset Verification fills this gap.

How DoxAI Enhances PPSR Asset Verification

Asset Verification is a digital, smart and user friendly inspection platform to verify assets like vehicles, equipment and collectibles, capturing high res photos, videos, documents and ownership details. Buyers and financiers can validate vendors, confirm ownership and check incumbency.

DoxAI combines ppsr search results with AI driven document intelligence to:

- Read vin, vin number, and vehicle vin from images

- Detect tampering in VIN plates rego papers and invoices

- Match vin search results across all documents

- Deliver a unified asset risk report alongside the official ppsr certificate

This reduces fraud accelerates approvals and strengthens compliance.

Why Lenders Choose DoxAI for Asset Verification

- Reduces fraud by detecting tampered or inconsistent documents

- AI document verification to detect tampered or inconsistent VINs, rego papers, invoices, and IDs

- Cross‑document data matching to ensure vehicle details like VIN, engine number, model, and registration align with PPSR findings

- Cuts processing time for asset finance deals

- Compliance‑ready reports, including the official PPSR certificate accepted by financial institutions

- Automated risk scoring for faster, more accurate decisioning

- Strengthens PPSR/REVS checks with AI insights

- Supports large broker networks and high‑volume workflows

PPSR Alone vs DoxAI Enhanced Verification

| PPSR/REVS Alone | DoxAI + PPSR/REVS |

| Shows encumbrances, stolen status, write‑offs | Confirms whether submitted documents match PPSR data |

| Provides official certificate for compliance | Adds AI fraud detection and cross‑document integrity checks |

| VIN‑based identity confirmation | Extracts and verifies VIN across all documents and images |

| Basic vehicle details from NEVDIS/PPSR | Detects tampering, cloning, mismatched numbers, altered PDFs |

| No insight into seller behaviour | Highlights fraud patterns, repeated document use, anomalies |

PPSR vs REVS

Simplified for Lenders

| Feature | REVS (Legacy) | PPSR (Current) |

| System | Old state‑based registers | National unified register |

| Shows finance owing | Yes | Yes |

| Shows stolen/write‑off | Yes | Yes |

| Certificate provided | No | Yes (official PPSR certificate) |

| Lender suitability | Limited | Highly suitable for lending compliance |

PPSR Checks Are Essential But Not Sufficient

A ppsr check, ppsr seach, or ppsr car check is essential for asset finance.

But modern lenders require more than a database search.

DoxAI Asset Verification delivers AI powered intelligence on top of PPSR to help lenders approve faster detect fraud earlier and protect portfolios.

Talk to us today to enable AI powered ppsr, ppsr checks, and advanced vin check australia workflows across your lending operations.

About DoxAI

DoxAI is your trusted process automation partner, enabling to transition from outdated systems to cutting-edge AI technology. Our platform streamlines the collection, management, processing, and storage of data, enhancing security, reducing operational costs, and boosting customer engagement. DoxAI empowers providers to automate and secure every step of their data and document handling processes. Our suite of products supports end-to-end workflows, from intake to archiving, ensuring privacy, compliance and faster service delivery.

Author

-

Sayem Shakir is a marketing and growth leader for AI, automation, and regulated technology platforms. He specialises in translating complex AI, data governance, and compliance driven products into clear, commercially relevant content for C suite and enterprise audiences. He has over 12 years of experience across marketing, sales, and strategy, with hands on leadership roles spanning fintech, legal tech, govtech, and enterprise AI. Sayem has led go to market strategy, demand generation, content, events, and partnerships, helping technology companies scale adoption in highly regulated industries. His work focuses on AI solutions, digital transformation, AI risk & governance, secure document intelligence, secure verification solutions, and automation in finance, healthcare, legal, education, and government. He regularly writes and advises on responsible AI adoption, risk, and compliance.

Frequently Asked Questions

What is a PPSR check and why is it important for lenders?

A PPSR check confirms whether a vehicle or other personal property has existing finance owing, is recorded as stolen, or has been written off. For lenders, PPSR checks reduce the risk of funding encumbered or non-recoverable assets and form part of standard lending compliance in Australia.

What is the difference between a PPSR check and a REVS check?

A REVS check is the legacy state-based system that existed before 2012. Today, a REVS check refers to a PPSR vehicle check performed through the national Personal Property Securities Register. PPSR provides a single national view and issues an official PPSR certificate suitable for lending compliance.

What does a PPSR report show?

A PPSR report shows security interests registered against an asset, stolen vehicle indicators, write off history, VIN or chassis details, and includes an official PPSR certificate. Lenders use PPSR reports as part of credit assessment, audit files, and regulatory review processes.

Is a PPSR check enough to verify a vehicle or asset?

No. A PPSR check confirms what is recorded on official registers but does not verify whether the documents submitted with a loan application are genuine. Fraud can still occur through altered VIN images, manipulated registration papers, or inconsistent supporting documents.

What is a PPSR VIN check?

A PPSR VIN check uses the vehicle identification number to search the PPSR database and confirm whether the vehicle has finance owing, is stolen, or has been written off. It helps lenders confirm they are assessing the correct vehicle but does not validate document authenticity on its own.

Why do lenders still experience fraud after PPSR checks?

Fraud occurs when documents are altered, reused, or fabricated even though the PPSR record itself is clean. Examples include tampered VIN plates, mismatched engine numbers, cloned vehicle details, and inconsistent registration information across documents.

How can lenders verify a VIN correctly?

To verify a VIN properly, lenders should check VIN consistency across all submitted documents, verify the VIN number against PPSR records, confirm vehicle details from images and registration papers, and identify discrepancies early. Manual checks are time consuming and prone to error at scale.

How does DoxAI improve PPSR and REVS checks?

DoxAI enhances PPSR checks by adding AI driven document intelligence. It reads VINs from images, detects tampering in VIN plates and documents, matches vehicle details across files, and produces a unified asset risk report alongside the official PPSR certificate.

Is DoxAI safe for lenders handling sensitive customer data?

Yes. For regulated industries, the relevant question is whether security controls, governance, and auditability are enterprise grade. DoxAI is designed for high assurance environments and supports controlled access, traceable actions, and compliance aligned handling of sensitive customer data.

What security controls does DoxAI use to protect customer data?

DoxAI applies enterprise grade security controls designed to safeguard sensitive customer data. These measures include encryption at rest and encryption in transit, comprehensive audit logs, robust access management, approval based data access, multi factor authentication across the business, IP filtering, annual external audits, and regular cybersecurity penetration tests.

DoxAI is compliant with GDPR, PCI DSS, SOC 2 Type 2, HIPAA, and ISO 27001, with annual external audits and regular penetration testing supporting ongoing assurance.

Does DoxAI replace PPSR checks?

No. DoxAI does not replace PPSR checks. It strengthens them. PPSR remains the legal foundation, while DoxAI adds intelligence to verify documents, detect fraud, and improve confidence in asset backed lending decisions.

How fast can PPSR checks and asset verification be completed?

Traditional PPSR checks are quick, but manual document verification can delay approvals. With DoxAI Asset Verification, lenders can complete PPSR checks and document validation within minutes, significantly reducing turnaround time for asset finance decisions. Want to see it in action? Book a free demo.

Is DoxAI suitable for large broker and lender networks?

Yes. DoxAI is designed to support high volume workflows across broker networks, lenders, and enterprise finance teams. It automates verification, reduces manual review effort, and provides compliance ready reporting at scale. DoxAI has a network of over 6,000+ brokers and 42+ Lenders.