Key Insights

Understanding the pain points that impact profitability, compliance, and operational efficiency in banking

81%

Complex Legacy System

One of the major roadblocks for modern digitalisation for organisations in Financial services.

63%

Inefficient Vendor Management

Inefficiency and reduced productivity resulting from juggling multiple vendors and relying on suboptimal tools.

4.26M

Avg. Data Breach Cost

The top priority for financial institutions over the next 12 months is to detect and prevent fraud, theft, and data breaches.

58%

Enterprise IT Flaws

Flawed IT systems disrupt business-as-usual on a weekly basis, resulting in inefficient end-to-end processes.

Data sourced from credible banking industry surveys and studies.

The Top 5 Most Impactful Takeaways

Learning the fundamental concerns and addressing key queries of the audience at the Digital Banking Summit 2025

Manual Repetitive Tasks Overhaul

DoxAI’s API-first, agnostic & modular technology stack plugs into existing processes with no disruption making workflow automation a reality.

Consolidated Vendor Management

Banks lack resources to support their end-to-end loan lifecycle coverage under one trustworthy partner, eliminating vendor sprawl, streamlining data flow, and cutting operational costs.

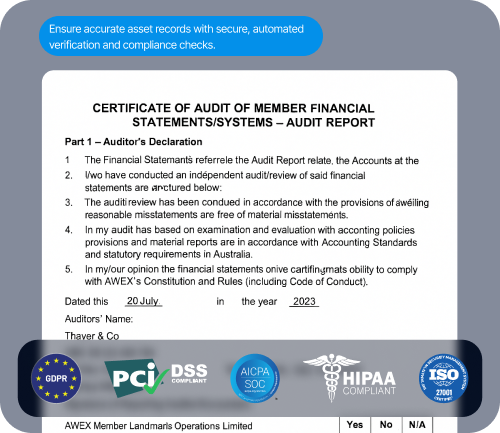

Customer Data Integrity

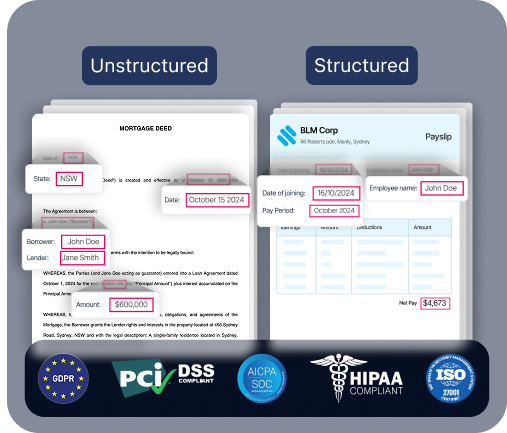

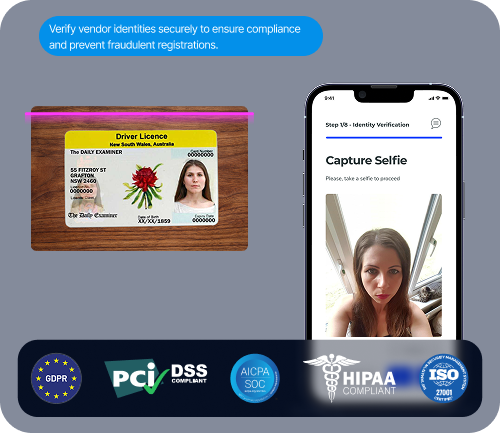

In response to rising organised crime such as data fraud and theft, DoxAI employs robust proprietary security measures and full compliance with SOC 2, PCI DSS, ISO 27001, GDPR, and HIPAA safeguarding data integrity and sovereignty.

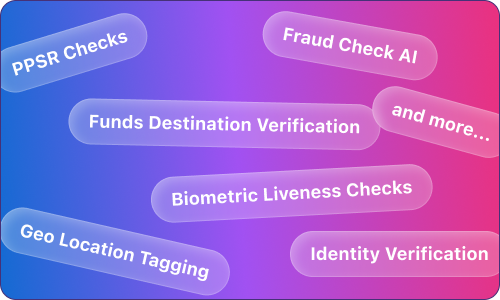

Demand for Specific AI Solutions

Banks highlighted strong demand for specialised AI functionalities like fraud detection in documents, identity verification, data & document extraction, data categorisation & redaction which can easily integrate into existing systems.

Value of DoxAI’s Modular Approach

Banks highlighted strong demand for specialised AI functionalities like identity verification, document extraction, transaction categorisation, redaction, and fraud detection—easily integrated into existing systems.

Our Products

How we fit in

Extract AI

Redact AI

Data Exchange

eSignature

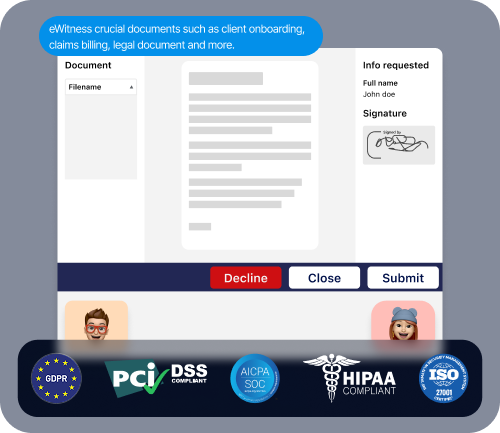

eWitnessing

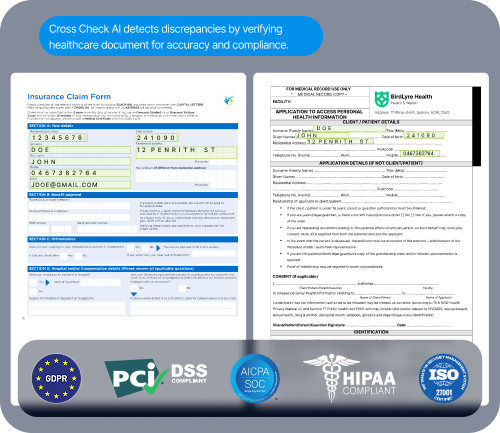

Cross-Check AI

Categorise & Split AI

Identity Verification

eVault

eForms

Asset Verification

Extract AI

Automate extractions from structured or unstructured documents securely and accurately in seconds. Supporting all file types, including PDFs, Image Files, Texts, Excel, and more.

Use-Cases

Identity Documents

Payslips

Invoices & Purchase orders

Bank statements

Legal Phrases Extraction

Forms & Reports

Tax Documents

Large Number of File Extraction

and more

Identity Documents

Payslips

Invoices & Purchase orders

Bank statements

Legal Phrases Extraction

Forms & Reports

Tax Documents

Large Number of File Extraction

and more

Benefits & Features

80%

Reduce operational costs by eliminating the need for frequent constant manual intervention.

40x

Achieve faster customer response times with automated processing of large volumes of documents.

99.97%

Experience accuracy in data extraction, significantly reducing errors compared to manual processes.

![Reduce operational costs]()

80%

Reduce operational costs by eliminating the need for frequent constant manual intervention.

40x

Achieve faster customer response times with automated processing of large volumes of documents.

99.97%

Experience accuracy in data extraction, significantly reducing errors compared to manual processes.

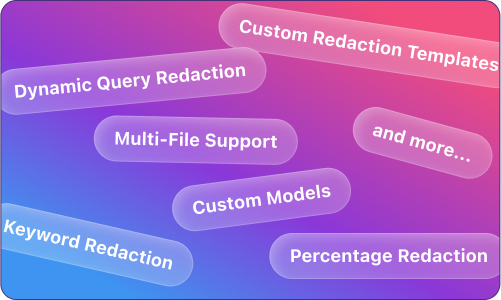

Redact AI

An AI/ML redaction solution for structured & unstructured documents that automate the process of identifying personal & sensitive information from documents, text, audio & more.

Use-Cases

Financial Documents

Document Archiving

Large Number of File Redactions

Invoice, Claims & Billing

Research Documents

Journalistic integrity

Clinical Trial Consent Forms

Large Archive Redaction Processing

and more

Financial Documents

Document Archiving

Large Number of File Redactions

Invoice, Claims & Billing

Research Documents

Journalistic integrity

Clinical Trial Consent Forms

Large Archive Redaction Processing

and more

Benefits & Features

100x

Faster than manual redaction. Redact 30 pages in less than 10 seconds.

45%

Reduction in common human errors associated with manual redaction processes.

8x

More effective than manual redaction on a 30-page document.

100x

Faster than manual redaction. Redact 30 pages in less than 10 seconds.

45%

Reduction in common human errors associated with manual redaction processes.

8x

More effective than manual redaction on a 30-page document.

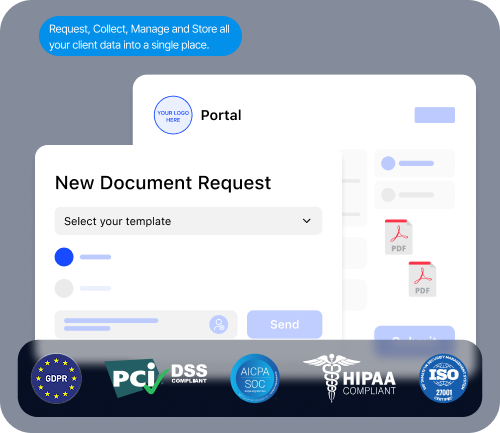

Data Exchange

Data Exchange is a secure exchange platform that enables end-to-end automation for collecting, managing, and sharing sensitive data and documents.

Use-Cases

Vendor Management

Loan Origination

Client Onboarding

Workflow Automation

Credit Risk Assessment

Document Archiving

Tracking & Reporting

Document Collaboration

Mortgage & Real Estate Financing

and more

Vendor Management

Loan Origination

Client Onboarding

Workflow Automation

Credit Risk Assessment

Document Archiving

Tracking & Reporting

Document Collaboration

Mortgage & Real Estate Financing

and more

Benefits & Features

82%

Boost in efficiency compared to a vulnerable and manual collection via email.

90%

Reduction in document processing time through automation.

5x

Cost reduction based on a semi-automated process with an existing customer.

82%

Boost in efficiency compared to a vulnerable and manual collection via email.

90%

Reduction in document processing time through automation.

5x

Cost reduction based on a semi-automated process with an existing customer.

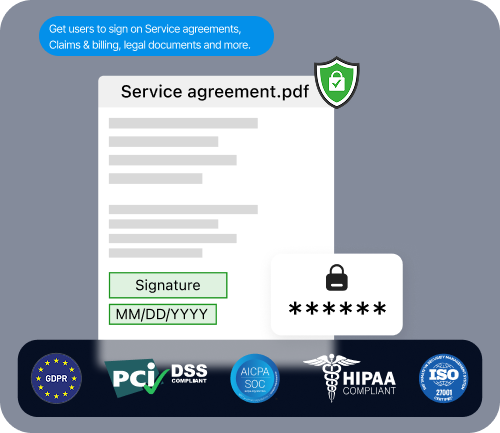

eSignature

A secure, legally binding eSignature platform for all businesses, offering bulk signing, unlimited users, and streamlined workflows to boost efficiency.

Use-Cases

Pre/Post Approval Agreements

Client Onboarding

Contract Management

Human Resources

Real Estate Transactions

Claims & Billing

Legal Documents

Procurement & Supply Chain

and more

Pre/Post Approval Agreements

Client Onboarding

Contract Management

Human Resources

Real Estate Transactions

Claims & Billing

Legal Documents

Procurement & Supply Chain

and more

Benefits & Features

80%

Reduction in data collection, application and contract signing time.

90%

Automated touch-less processing in the entire electronic signing workflow

80%

Reduction in contract processing time due to automated workflow

80%

Reduction in data collection, application and contract signing time.

90%

Automated touch-less processing in the entire electronic signing workflow

80%

Reduction in contract processing time due to automated workflow

eWitnessing

DoxAI e-Witnessing allows you to select one or more people to be present digitally to witness when crucial contracts, documents or deeds are being signed.

Use-Cases

Pre/Post Approval Agreements

Client Onboarding

Contract Management

Human Resources

Real Estate Transactions

Claims & Billing

Legal Documents

Procurement & Supply Chain

and more

Pre/Post Approval Agreements

Client Onboarding

Contract Management

Human Resources

Real Estate Transactions

Claims & Billing

Legal Documents

Procurement & Supply Chain

and more

Benefits & Features

80%

Reduction in data collection, application and contract signing time.

90%

Automated touch-less processing in the entire electronic signing workflow

80%

Reduction in contract processing time due to automated workflow

80%

Reduction in data collection, application and contract signing time.

90%

Automated touch-less processing in the entire electronic signing workflow

80%

Reduction in contract processing time due to automated workflow

Cross-Check AI

Advanced AI and ML tool that can validate, identify and resolve data discrepancies, inconsistencies and errors within multiple datasets like docs, databases & audio files.

Use-Cases

Mortgage Fraud Prevention

Loan Agreements

Client & Vendor Contracts

PDS Statements

Mortgage Deeds

Financial Statements

Mortgage Deeds

Research & Reporting

Audit & Compliance Records

and more

Mortgage Fraud Prevention

Loan Agreements

Client & Vendor Contracts

PDS Statements

Mortgage Deeds

Financial Statements

Mortgage Deeds

Research & Reporting

Audit & Compliance Records

and more

Benefits & Features

95%

Operational cost reduction on average based on existing clients.

32X

Faster than a human at cross checking data on a 35 items checklist.

80%

Of Existing workflow automated through AI & ML based on existing clients.

95%

Operational cost reduction on average based on existing clients.

32X

Faster than a human at cross checking data on a 35 items checklist.

80%

Of Existing workflow automated through AI & ML based on existing clients.

Categorise & Split AI

Document categorisation and splitting solution that leverages advanced AI & ML algorithms to automatically classify, organise and split documents.

Use-Cases

Underwriting Automation

Document Collection

Filing & Archiving

Folder Organisation

Financial Documents Handling

File Sharing

File Management

Bulk File Uploads

and more

Underwriting Automation

Document Collection

Filing & Archiving

Folder Organisation

Financial Documents Handling

File Sharing

File Management

Bulk File Uploads

and more

Benefits & Features

98%

Accuracy in page categorisation compared to manual categorisation.

100x

Faster than manual reading and categorising a 10-page document

95%

Operational cost reduction on average based on existing clients.

98%

Accuracy in page categorisation compared to manual categorisation.

100x

Faster than manual reading and categorising a 10-page document

95%

Operational cost reduction on average based on existing clients.

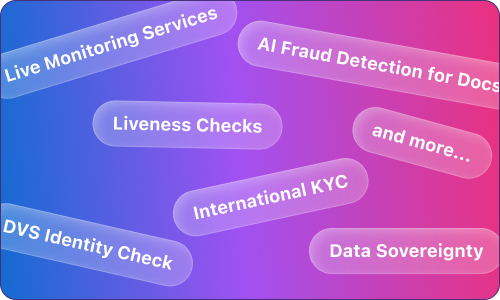

Identity Verification

Automate the verification of identity (VOI) for individuals or businesses like AML, CTF, OFAC, KYC, KYB, PEP, Biometrics including Constant Monitoring, in seconds.

Use-Cases

Client & Vendor Onboarding

Identity Theft Detection

Fraud & Document Check

Regulatory Compliance

Client Lifecycle Updates

Asset Ownership Checks

Insurance & Claims Checks

and more

Client & Vendor Onboarding

Identity Theft Detection

Fraud & Document Check

Regulatory Compliance

Client Lifecycle Updates

Asset Ownership Checks

Insurance & Claims Checks

and more

Benefits & Features

99.97%

Accuracy in automated identity verifications compared to manual verifications.

100x

Faster onboarding and admissions in seconds compared to manual ID review.

90%

Reduction in verification costs due to elimination of paper processes, errors, and rework.

99.97%

Accuracy in automated identity verifications compared to manual verifications.

100x

Faster onboarding and admissions in seconds compared to manual ID review.

90%

Reduction in verification costs due to elimination of paper processes, errors, and rework.

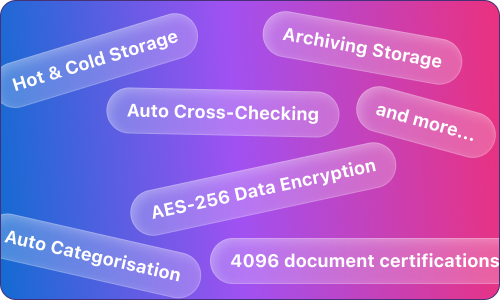

eVault

Store, encrypt and manage your organisation's data with our eVault service, built with cyber security in mind to protect against data breaches and compliance issues.

Use-Cases

Financial Documents

Internal Policy

Dispute Resolution & Litigation

Insurance Documents

Research Documents

Client Reports

Mortgage Consent Forms

Compliance Archiving

and more

Financial Documents

Internal Policy

Dispute Resolution & Litigation

Insurance Documents

Research Documents

Client Reports

Mortgage Consent Forms

Compliance Archiving

and more

Benefits & Features

99.97%

Reduction in data breach risk compared to storing it manually on-premises systems.

90%

Faster data retrieval in seconds like health records compared to manual searching.

92%

Reduction in physical onsite storage costs and operational costs.

99.97%

Reduction in data breach risk compared to storing it manually on-premises systems.

90%

Faster data retrieval in seconds like health records compared to manual searching.

92%

Reduction in physical onsite storage costs and operational costs.

eForms

Create, collect, manage, and store data effortlessly. Streamline your workflow with DoxAI eForms – smart, customisable, and designed to fit your business needs.

Use-Cases

Client Applications

Loan Assessments

Consent & Procedure Authorisations

Staff Onboarding

Insurance & Billing

Surveys & Feedback

Research & Reporting

Customer Engagement

and more

Client Applications

Loan Assessments

Consent & Procedure Authorisations

Staff Onboarding

Insurance & Billing

Surveys & Feedback

Research & Reporting

Customer Engagement

and more

Benefits & Features

99%

Reduction in data entry errors compared to manual form filling with automated data checks.

10x

Reduction in processing times from paper-based to fully automated & digital submissions.

90%

Savings in operational costs due to reduction in printing, storage and manual paperwork.

99%

Reduction in data entry errors compared to manual form filling with automated data checks.

10x

Reduction in processing times from paper-based to fully automated & digital submissions.

90%

Savings in operational costs due to reduction in printing, storage and manual paperwork.

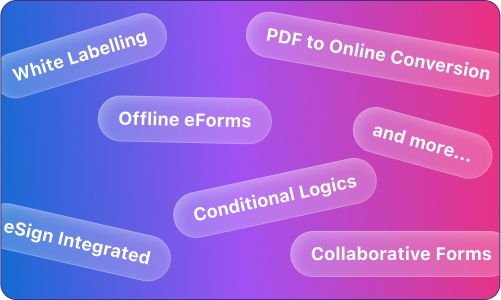

Asset Verification

A digital, user friendly inspection platform where buyers and financiers can validate vendors and any assets within 30 minutes.

Use-Cases

Office Equipment & Inventory

Vendor & Procurement Verification

Financial Audit & Insurance Claims

Facility & Infrastructure Management

Company Vehicles Verifications

Second-Hand Equipment Verification

and more

Office Equipment & Inventory

Vendor & Procurement Verification

Financial Audit & Insurance Claims

Facility & Infrastructure Management

Company Vehicles Verifications

Second-Hand Equipment Verification

and more

Benefits & Features

97%

Reduce fraud risk with streamlined verification for confident, informed decisions.

100x

Reduce manual verification time from 1-3 days to just 30 minutes through automated process.

80%

Reduction in asset verification costs with automated data collection and checks.

97%

Reduce fraud risk with streamlined verification for confident, informed decisions.

100x

Reduce manual verification time from 1-3 days to just 30 minutes through automated process.

80%

Reduction in asset verification costs with automated data collection and checks.

Use Cases for Retail, Commercial, Asset Financing

How we can automate your processes based on some example use cases, but not limited to:

Client Onboarding

Data, document collection, management & storage

Knowledge base dynamic queries, & decision

Document forgery & unauthorised edits detection

Summarisation of data & documents

Digital eForms for efficient fact-finding & surveys

Detect & redact TFNs, credit cards, & more

Automated Contract Management

Customisable client notifications & reminders

Verification of assets, equipment & vendors

Pre/post-approval via eSignature & eWitness

Document analysis & highlighting of key data

VOI, KYB, AML/CTF, PEP, Sanctions & Adverse Media

Case Management & Preparation

Automated financial document verification

Categorise & extract data from mortgage documents

Crosscheck for verification within 50+ datasets

and more

Why Choose Us

We adhere to stringent information security policies to safeguard your sensitive customer data. Our measures include best-in-class encryption (at rest and in transit), comprehensive audit logs, robust access management, approval-based data access, multi-factor authentication across our business, IP filtering, and more. We are SOC2 Type 2 certified and PCI DSS compliant, with annual external audits and regular cybersecurity penetration tests.

Our robust and scalable infrastructure empowers your business to grow without compromising performance or stability. Our cloud-based technology features highly automated scalability, both horizontally and vertically, within a service-oriented architecture. Additionally, we comply with local data sovereignty requirements, ensuring data is stored locally to meet regulatory standards and protect your information.

Experience industry-leading uptime and availability, allowing you to focus on serving your customers without interruption. We offer 99.97% uptime, live data replication across multiple geolocations, and the option to select preferred data locations based on jurisdiction.

Trusted by

Free Proof Of Concept, Tailored Just For You

Please fill out the details

Disclaimer - **This free Proof of Concept (PoC) is for demonstration and trial purposes only, subject to fair use and DoxAI’s terms. Misuse or unauthorised use is prohibited. DoxAI Australia Pty Ltd reserves final discretion.**

Recognised Innovator

Australian AI Awards 2024

AI Innovator-Customer Banking

Finnies Finalist 2025

Most Innovative Application of AI in Finance & Excellence in establishing global market presence

IABCA Finalist 2025

Excellence in Innovation

AI Agent Marketplace

Best AI for Banks

Cyber Security

Digital Transformation

AI Solutions for Banks

Artificial Intelligence

Process Automation

Data Redaction

Document Categorisation

AI Summarisation of Documents

AI Decision Making

AI for Compliance

AI for Finance Industry

Data & Document Collection

Data Automation

Data Extraction

Loan Processing Automation

Mortgage Process Automation

Finance Automation

Fraud Check

Banking Digitalisation

AI & automation solutions for banking & finance

Scroll to top