Setting the Gold Standard

DoxAI was named a GSI Gold Standard In AI 2025 winner by SoftwareVerdict® for our AI solutions; recognised for real-world impact, reliability and governance.

Read the reportSecure and Scalable Vendor & Asset Validations

with Asset Verification

0

Brokers

0

Verifications Completed

0+

Lenders

Secure

SOC 2 Type 2 certified, automated redaction, and data-purge rules to protect information, reducing breaches.

Fast

Automation cuts manual verification time from the industry standard of 3 to 5 business days to just a few minutes.

Plug n Play

Agnostic to the medium, easy to integrate into existing workflows or legacy systems via iFrame or API in less than a week.

Watch DoxAI Asset Verification in Action

For Lenders

For Brokers

For Sellers

Verify the Authenticity of Assets and

their Sellers in a Digital Platform

Security & Trust

ID Verification - Secured & Simplified

Verify individuals (VOI) comprehensively against government databases (DVS) with biometric face recognition and liveness checks in seconds (ARNECC’s reasonable steps applied) ensuring security from fraudulent submissions.

Extensive Compliance

Comprehensive reporting with PPSR Checks

Confirm security interests, theft records, write off status and detailed vehicle information including make, model, colour, year, engine number, body type and vehicle category through PPSR.

Fraud Detection

AI-Powered Fraud Check

Prevent fraudulent document submissions with advanced AI powered fraud detection. Streamline processes with AI-driven photo and document verification and geolocation tags for greater security than traditional methods, saving time for lenders and brokers.

Enhanced Efficiency

Automated Private Sale Invoice

Experience super-fast private sale invoice process via invoice generation automation that includes digital eSignatures for both sellers and buyers removing the need for manual form filling.

-

Consistent Templates

-

Automated Data Entry

-

Accurate Data Capture

Key Features

Your all-in-one asset verification powerhouse, with over 20+ features for a faster, easier workflow.

Facial Recognition

Added layer of security eliminating impersonation or fraud with advanced facial recognition technology.

Biometric Liveness Check

Liveness verification ensures that individuals' images and videos are not artificially generated or altered.

Deep Fake Detection

AI-driven deepfake detection to identify any manipulations.

Number Plate OCR

Automated Number Plate Recognition with OCR for quicker verification.

VIN/HIN OCR

Automated extraction of VIN/ HIN for reduced manual error.

Asset Details & Photos

Collection & verification of all asset information including 360 degree videos & all-important photos.

Proof of Ownership

Verifies the ownership of the asset by automatically cross-checking the ownership documents and government records.

Funds Destination Verification

Bank account and account holder verification to prevent potential fraud.

AI-Powered Cross Check

Automatically cross-check data and documents for enhanced accuracy and consistency.

Location & Timestamp

GPS location and timestamp on all information uploaded to ensure consistency.

Personalised Landing Page

Allows users to have their personalised landing page, highlighting their brand identity with their logo.

Customisable Report Template

Inclusion of logos and colours, providing a professional and tailored touch to the reports.

Secure and Scalable

Enterprise-grade Security

We adhere to stringent information security policies to safeguard your sensitive customer data. Our measures include best-in-class encryption (at rest and in transit), comprehensive audit logs, robust access management, approval-based data access, multi-factor authentication across our business, IP filtering, and more. We are GDPR, PCI DSS, SOC2 Type 2, HIPAA, and ISO27001 compliant, with annual external audits and regular cybersecurity penetration tests.

Scalable Infrastructure

Our robust and scalable infrastructure empowers your business to grow without compromising performance or stability. Our cloud-based technology features highly automated scalability, both horizontally and vertically, within a service-oriented architecture. Additionally, we comply with local data sovereignty requirements, ensuring data is stored locally to meet regulatory standards and protect your information.

Reliable Uptime

Experience industry-leading uptime and availability, allowing you to focus on serving your customers without interruption. We offer 99.97% uptime, live data replication across multiple geolocations, and the option to select preferred data locations based on jurisdiction.

What Our Clients Say

Discover what our satisfied customers have to say about their experiences with our product/services

By integrating DoxAl's Asset Verification advanced technology, we noticed significant improvements in our settlement experience, which ultimately led to heightened satisfaction levels among both our brokers and customers. The process became smoother, faster, and more efficient, allowing us to serve all stakeholders with greater confidence and reliability.

DoxAI Asset Verification has provided us with the confidence that we are engaging with the correct owner and vehicle during private sales. The platform's ability to gain consent and store vendor and vehicle details on their end has significantly reduced our need for additional interactions with vendors, streamlining our processes.

A flexible, smart and commercial approach from the DoxAl team, coupled with their hands-on experience in Al technology makes them a natural go-to-choice for any organisation seeking Al solutions for their business.

Sydney, Australia

Asset Verification has saved us and our brokers time in getting an inspection completed, as well as in collecting data, speeding up the settlement process and getting the customer their asset much sooner.

Looking to Buy, Sell or Finance Assets Digitally?

Protect your investment with detailed asset inspection reports, including car inspection, auto inspection, thorough vehicle checks and VOI for vendors. Whether you are after a pre-purchase car inspection or a quick state car inspection, our digital asset verification solution ensures accuracy, confirms ownership and eliminates fraud related risks.

Keen to learn more? Click below to Book a ‘Free Demo’.

Recognised Innovator

Proud finalist for the Australian AI Awards 2025 in the categories - AI Innovator in Mortgage Broking, AI Innovator for Start Up, Best use of AI for Sustainability, AI Innovator in Consumer Banking, Best Use of Agentic AI and finalists for the Smart50 2025 in the categories - Innovator Award, Sustainability Award and Founder of the Year Award.

Business Benefits

97

%

Reduction in fraud risk through our streamlined verification process, enabling you to make confident, informed decisions.

100

x

Reduce manual verification time from 3-5 business days to just minutes.

80

%

Cost reduction in your asset verification processes by automatic data collection and verification.

*Note that the benefits listed above are based on current client outcomes and may vary depending on your specific use case.

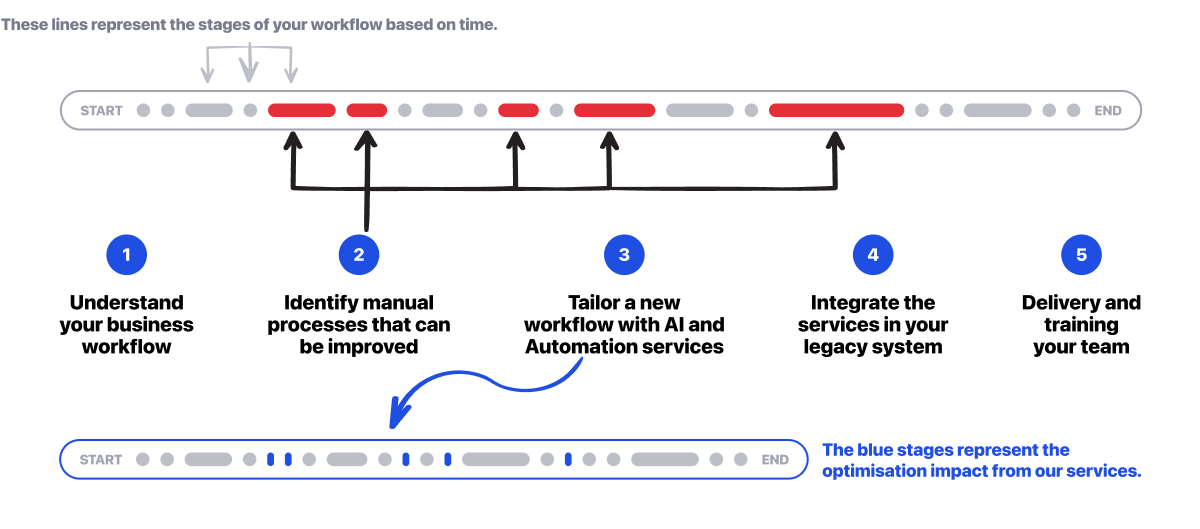

How We Boost Your Workflow