Setting the Gold Standard

DoxAI was named a GSI Gold Standard In AI 2025 winner by SoftwareVerdict® for our AI solutions; recognised for real-world impact, reliability and governance.

Read the reportSecure and Scalable Automated Data & Document

Validation with Cross Check AI

Secure

SOC 2 Type 2 certified, automated redaction, and data-purge rules to protect information, reducing breaches.

Fast

Automation cuts manual verification time from the industry standard of 3 to 5 business days to just a few minutes.

Plug n Play

Agnostic to the medium, easy to integrate into existing workflows or legacy systems via iFrame or API in less than a week.

Everything You Need to Cross Check

Data & Documents Online in One Place

Tailored Impact

Custom Checklist-Based

Cross-Checking

Configure dynamic checklists to perform automated cross-checking of data & documents based on your business logic. Whether you are verifying identity fields across KYC documents, or comparing asset values in loan applications, Cross‑Check AI ensures document level consistency with high precision. Ideal for teams searching for an AI document validation checklist tool.

Consistent Accuracy

AI-Powered Rule

Validation Engine

Define and enforce rule-based data verification with conditions like “must match, must not match, must not be empty, or must contain pattern”. This makes Cross‑Check AI a powerful data inconsistency detection tool, especially useful for businesses needing to verify extracted data fields across multiple documents automatically.

Enhanced Protection

Cross Data & Document

Comparison

Cross‑Check AI uses advanced artificial intelligence to compare documents and multiple files (e.g., payslips, IDs, bank statements and more). It detects mismatches, fraudulent entries, and missing data across formats. A perfect fit for users searching how to compare documents using AI or automated document reconciliation.

Boost Compliance

Dynamic Exception

Handling & Feedback Loop

When validations fail, exceptions are flagged with detailed reasoning. Reviewers can correct errors or provide feedback that improves future AI performance. This AI-powered cross-checking system evolves with every run, supporting compliance and auditability for businesses looking for smart document validation workflows that adapt.

AI Cross-Checking Features

Your all-in-one comparison powerhouse, with over 20+ features for a faster, easier workflow.

Custom Checklists

Create tailored checklists for specific verification needs.

Zip File Compatibility

Efficiently extract and verify data within zip files to streamline processes.

Rework Capabilities

Resend single or multiple documents for rework, allowing for real-time updates.

Bulk Processing

Process multiple individual groups of datasets simultaneously for increased efficiency.

Auto Classification

Automatically categorise files or documents uploaded via zip.

Auto-Splitting

Automatically split documents based on a page by page context base.

Calculations Verification

Ability to validate calculation check items with in one or multiple data sets.

Multi Dataset

Cross-check information across up to 50 individual files.

Complete Audit Logs

Maintain comprehensive audit logs to ensure transparency, accountability, and quality control during cross-check activities.

Discrepancies Detection

Identify inconsistencies across multiple data references or files.

Signatures Verification

Verify the presence and similarity of both handwritten and electronic signatures.

Virus and Corruption Scanning

Ensure all files are scanned for viruses and corruption before entering our systems.

Perfect For

Legal documents

Securitisation checks

Information validation

Healthcare records

Duplicate detection

Financial document validation and cross reference

Compliance and regulatory reporting

Financial services records

Large volume validation business

What Our Clients Say

Discover what our satisfied customers have to say about their experiences with our product/services

A flexible, smart and commercial approach from the DoxAl team, coupled with their hands-on experience in Al technology makes them a natural go-to-choice for any organisation seeking Al solutions for their business.

Sydney, Australia

Case Study of a Leading

Global Financial Services Organisation

Problem

Our client manages a large volume of loan documents daily, requiring cross-checking of General information, Personally Identifiable Information (PII) and Business Sensitive Information (BSI) across multiple groups of documents. The challenge was to efficiently verify details, ensure accuracy, and identify inconsistencies to streamline the processing workflow.

Solution

We implemented our advanced AI-driven cross check platform to automate the cross-checking of PII and BSI across numerous loan documents. The platform scans and compares data points such as names, addresses, and financial details, flagging discrepancies and ensuring consistency. They experienced an increased accuracy and consistency in handling sensitive information, leading to more efficient and reliable operations daily.

91%

Faster than the manual cross-checks in Processing Speed

70%

Reduction in the operational costs

10x

Increase in the processing of the documents

Secure and Scalable

Enterprise-grade Security

We adhere to stringent information security policies to safeguard your sensitive customer data. Our measures include best-in-class encryption (at rest and in transit), comprehensive audit logs, robust access management, approval-based data access, multi-factor authentication across our business, IP filtering, and more. We are GDPR, PCI DSS, SOC2 Type 2, HIPAA, and ISO27001 compliant, with annual external audits and regular cybersecurity penetration tests.

Scalable Infrastructure

Our robust and scalable infrastructure empowers your business to grow without compromising performance or stability. Our cloud-based technology features highly automated scalability, both horizontally and vertically, within a service-oriented architecture. Additionally, we comply with local data sovereignty requirements, ensuring data is stored locally to meet regulatory standards and protect your information.

Reliable Uptime

Experience industry-leading uptime and availability, allowing you to focus on serving your customers without interruption. We offer 99.97% uptime, live data replication across multiple geolocations, and the option to select preferred data locations based on jurisdiction.

Recognised Innovator

Proud finalist for the Australian AI Awards 2025 in the categories - AI Innovator in Mortgage Broking, AI Innovator for Start Up, Best use of AI for Sustainability, AI Innovator in Consumer Banking, Best Use of Agentic AI and finalists for the Smart50 2025 in the categories - Innovator Award, Sustainability Award and Founder of the Year Award.

Business Benefits

95

%

Operational cost reduction on average based on existing clients.

32

%

Faster than a human at cross checking data on a 35 items checklist.

97

%

Workflow automation based on existing clients.

*Note that the benefits listed above are based on current client outcomes and may vary depending on your specific use case.

How We Boost Your Workflow

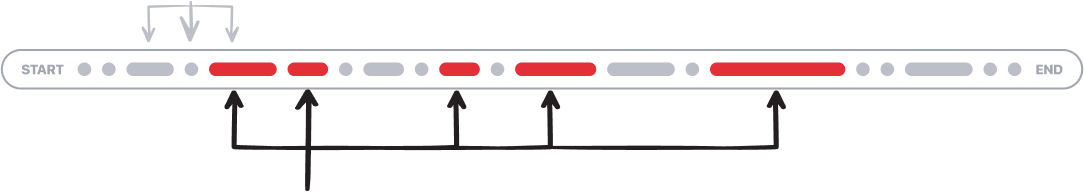

These lines represent the stages of your workflow based on time.

Understand your business workflow

Identify manual processes that can be improved

Tailor a new workflow with AI and Automation services

Integrate the services in your legacy system

Delivery and training your team

The blue stages represent the optimisation impact from our services.

Let’s Connect

We’re here to help! Have questions or need more information? Get in touch with us today.